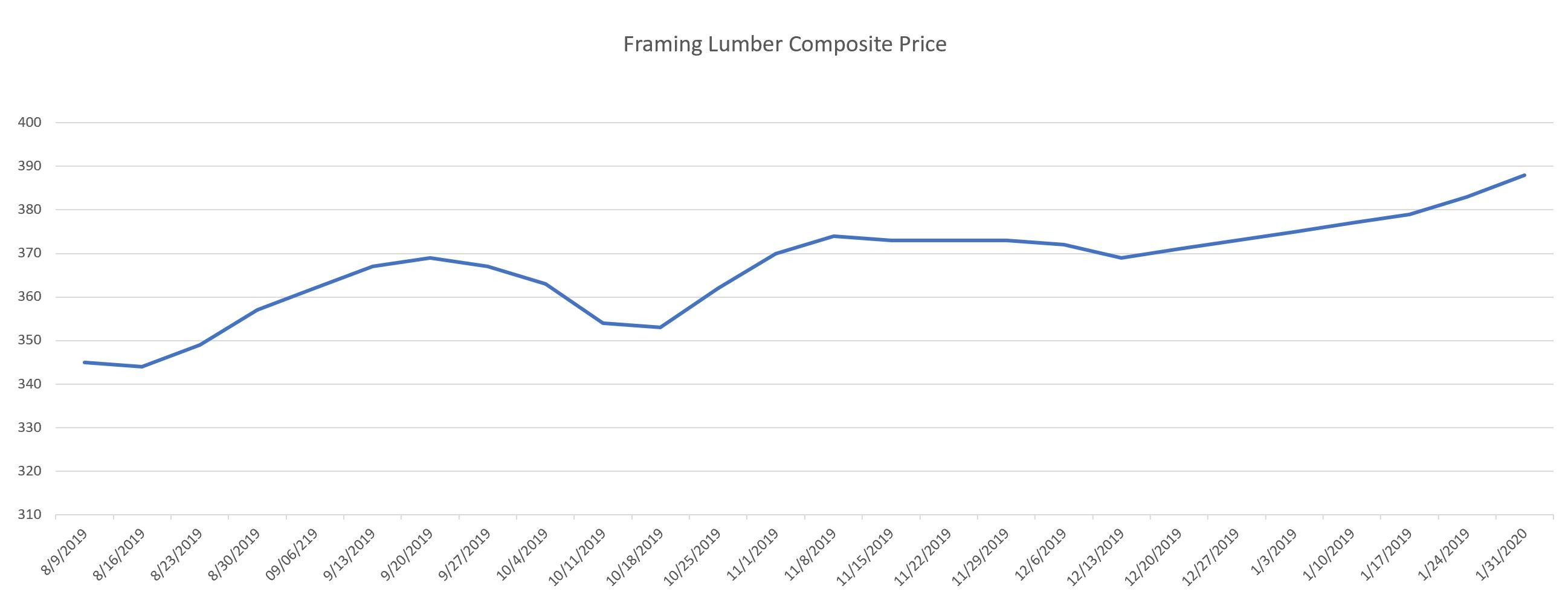

The result of this increase in demand, following the reduction in supply, has led to price increases for OSB, lumber, trusses and many other commodities. For example, the index for OSB just reached a 10-month high during a time of the year when prices are typically low.

Unfortunately, market analysts are predicting continued upward pricing pressure throughout the first half of the year. We will do everything possible to mitigate these increases

Mobile Home Prices Have Increased Substantially

The trajectory of mobile home prices in 2024-2025 reflects a continuation of the upward trend observed in previous years. Economic factors, supply-demand dynamics, investment sentiments, and regulatory influences collectively shape the market landscape.

A recent study found that mobile home prices increase an average of 34.6% from 2016 to 2021. This price increase is just slightly lower than the increase in single-family homes. Several factors, including economic conditions, are driving this rise.

The rise in home prices creates a frustrating situation for mobile homeowners and potential buyers. Many mobile homeowners are in a tough situation where they can’t benefit from the rise in home value. And potential mobile homeowners are being priced out of the market.

What’s Driving the Rise in Mobile Home Prices for 2024

There are several significant factors driving the rise in mobile home prices and will continue to drive pricing in 2024:

Home Scarcity

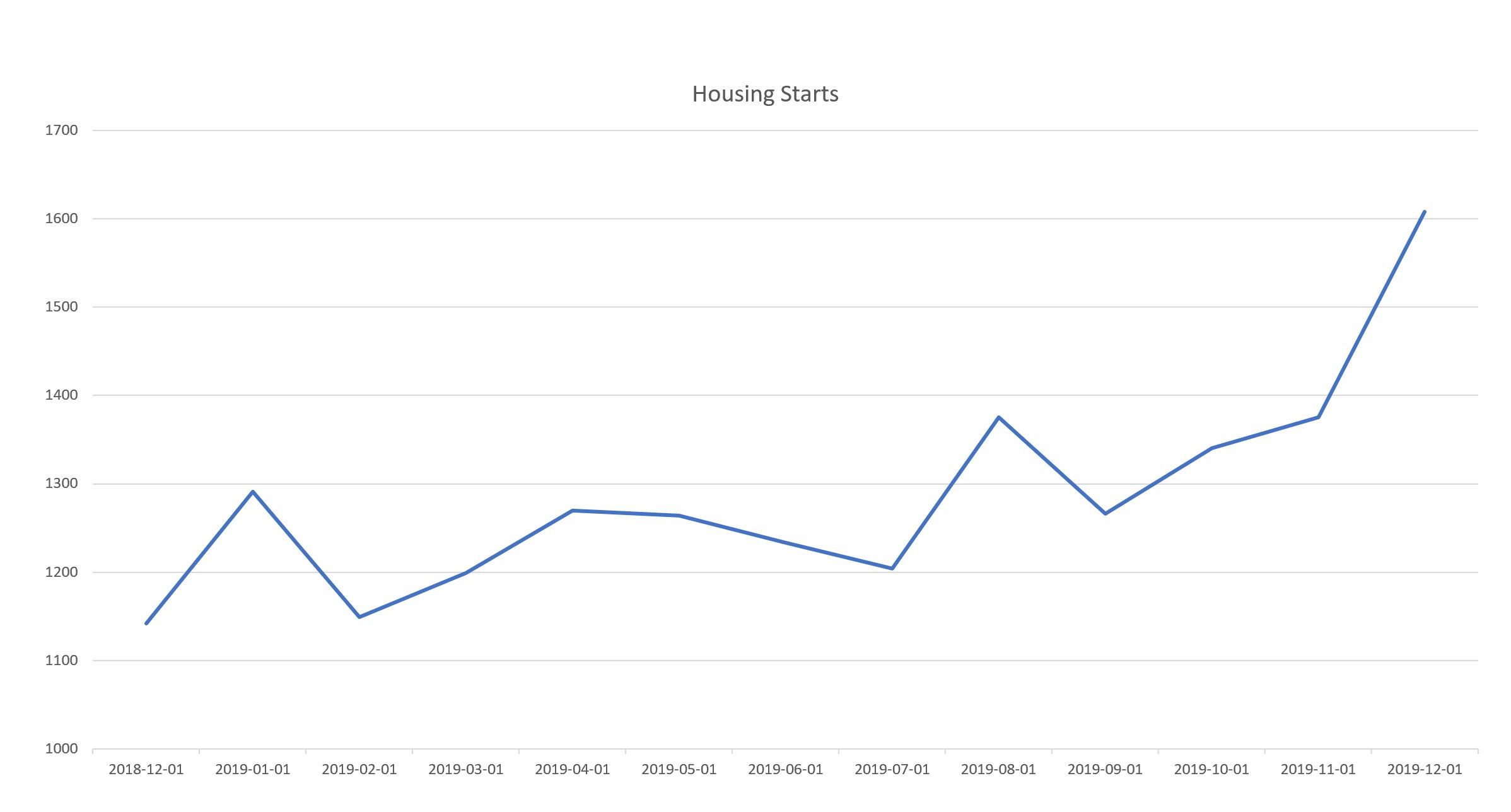

America has been in a home shortage for several years, driving the price for mobile homes as an affordable alternative. But now that interest rates are high, analysts predict that housing prices will drop by 10% or more.

While this could correct the dramatic rise over the past few years, it’s not likely to drop significantly because there are still not enough homes for the demand. This is difficult for new mobile home buyers and sellers as well because they are entering a tighter housing market.

The pandemic also contributed to mobile home scarcity because of supply chain and factory disruptions that reduced the number of mobile homes the builders offered. A problem still today, fewer homes with increased demand will continue to push up the price.

Corporate Investors

Corporate investors have been buying mobile communities across the US and then raising the rent for the land that the mobile homes are on. This increased rent then ups the price for mobile homeowners, making it difficult to make ends meet because many of these residents are elderly and on fixed incomes.

This forces the owners to sell their homes, which the corporate investors then lowball the sellers to acquire the property. The sellers lose, and anyone looking to rent will have to pay premium rental rates.

Inflation

Inflation is also taking its toll, making it more challenging to get loans because of higher interest rates. Many potential buyers struggle to secure loans at higher mobile home prices. And inflation is increasing the land rental fees, making it especially hard when wages aren’t matching the inflation increase.

Better Financing Options Through Home Nation

At Home Nation, we understand the struggles many mobile homeowners are facing. We offer affordable financing options to help people find housing to fit their family’s needs. We have several loans, including conventional, to ease the difficulty of rising home prices. Fill out our form to find out if you’re eligible.

We also offer an extensive inventory of high-quality new and used mobile homes to fit your living needs. Contact us to learn more about our mobile home floor plans and pricing.

Want to invest in a mobile home now before prices continue to rise? Learn more about our affordable, high-quality mobile homes.

|